<--Back

Tax

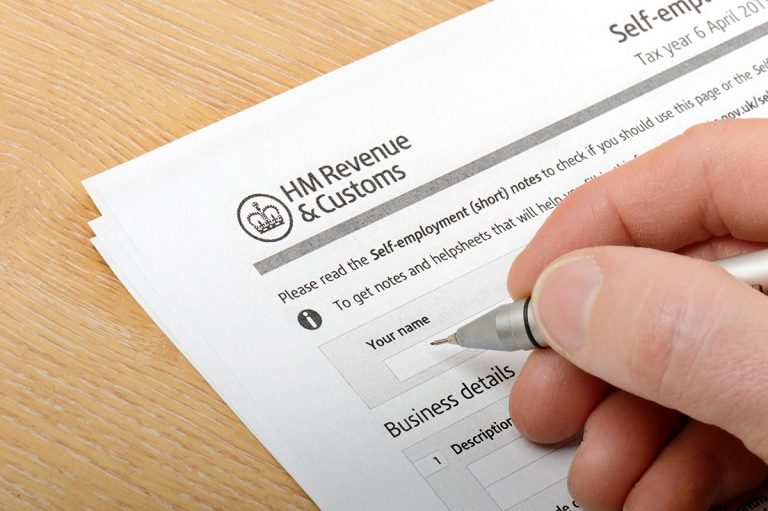

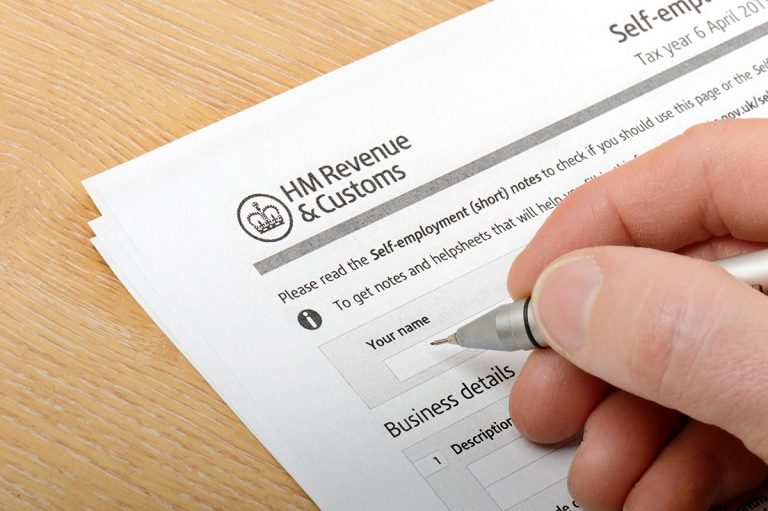

The tax system has become excessively complex through decades of government tinkering. This has seen the unhealthy growth of a corporate and personal tax-advisory sector, skilled in tax avoidance, which harms the financial well-being of the nation. TIME wishes to simplify tax assessment and collection via increased use of flat-rate taxes, creating a virtuous environment of clarity and integrity.

The UK tax system has become excessively complex as a result of decades of government tinkering, albeit to promote fairness where possible.

However, this has seen the unhealthy growth of a corporate and personal tax advisory sector, skilled in tax avoidance, which harms the financial health of the nation.

TIME wishes to simplify tax-assessment and tax-collection and thereby create a virtuous environment of clarity and integrity throughout the UK.

- Personal tax to be one Flat Rate Tax (to be determined).

- Increase your personal tax allowance to £17,000.

- Decrease Corporation Tax to 15%.

- Ensure global corporations operating in the UK yet headquartered and taxed elsewhere in the EU are fully taxed on their UK turnover via the implementation of a Net Revenue Tax (NRT), the percentage rate on revenue to be determined.

- Reduce VAT to 10%.

- Scrap Inheritance Tax (IHT) to eliminate double taxation.

- Scrap Capital Gains Tax (CGT).

- The Stamp Duty rate on a domestic property purchase will be calculated on the total value of the purchaser’s property portfolio, with the exception of local authority- and housing association-owned estates.

- Introduce an annual aggregated assessable Land Value Tax (LVT) on land ownership, to reduce corporate land banking.

- All global income of UK citizens will be subject to the Flat Rate Tax.

- No tax relief for Non-Domicile citizens (Non-Doms will be subject to the Flat Rate Tax).

- Scrap VAT on essential sanitary products.

- Scrap the TV licence.

Support Us!

Newsletter

Jump to :

Animal Welfare

Banking Reform

Defence

Education

Energy

Environment

Farming

Fisheries

Foreign Relations

Health

Housing

Immigration

Industry

International Aid

Justice

Pensions

Prison Reform

Recreational Cannabis

Reform of the United Kingdom

Sport & Leisure

Tackling Knife Crime

Tax

Trade

Transport

Veterans Affairs

Voting System Reform

Newsletter

Jump to :

Animal Welfare

Banking Reform

Defence

Education

Energy

Environment

Farming

Fisheries

Foreign Relations

Health

Housing

Immigration

Industry

International Aid

Justice

Pensions

Prison Reform

Recreational Cannabis

Reform of the United Kingdom

Sport & Leisure

Tackling Knife Crime

Tax

Trade

Transport

Veterans Affairs

Voting System Reform

The Time Party

The Time Party